Loan Calculator

When managing your finances, access to accurate tools can greatly simplify decision-making. Our Loan Calculator is designed to help you better understand your financial options by providing a powerful platform to calculate potential mortgage payments quickly and easily. Whether you’re planning to purchase a new home, pay for education, or make any other big purchase, it’s important to understand the impact of different loan options. Explore the features of our Calculator and see how it can revolutionize your financial strategy.

Consider the below scenario where you need a loan of $10,000 with a 10% interest rate, repayable over 10 months. Our calculations reveal that your monthly installment would be $1,046, with cumulative payments reaching $10,464 over the entire term, including $464 in total interest.

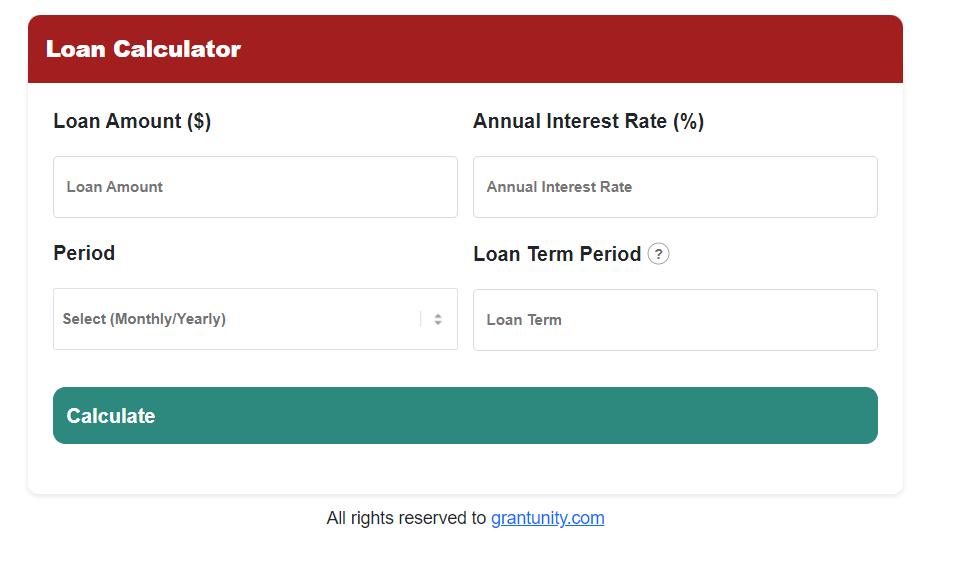

Loan Amount ($):

The Loan Amount is the cornerstone of any loan calculation, representing the principal you intend to borrow. Our Loan Calculator simplifies the process of entering this amount, immediately reflecting its impact on your monthly or annual payments. This direct feedback helps you understand the magnitude of your financial commitment in real time.

Example: Considering borrowing $15,000 for your education? Simply input this amount into our Loan Calculator to see how it shapes your repayment plan.

Annual Interest Rate (%):

The Annual Interest Rate is a critical factor in determining the total cost of your loan. Our calculator provides a clear input field for this percentage, allowing you to see how different rates affect your payment structure. This feature is invaluable for comparing various loan offers and choosing one that aligns with your financial goals.

Example: Evaluating loan options for a home renovation? Try inputting different interest rates, such as 7% and 9%, into the calculator to understand their implications on your monthly payments.

Term Period (Monthly/Yearly):

The flexibility to select between monthly and yearly repayment periods allows you to customize the loan according to your specific needs. Whether you’re a student or a professional making a significant investment, our tool helps you plan according to your cash flow and financial objectives.

Example: Opt for monthly payments to get a grasp on more immediate financial obligations, or select yearly payments to align the repayment with longer-term financial goals.

Loan Term Period (in years or months):

Adjusting the Loan Term Period offers precise control over how long you will be paying off the loan. This adjustment directly influences your payment amounts, helping you to manage how the loan fits into your broader financial landscape.

Example: Changing the term to 3 years versus 5 years can significantly alter monthly payments. Experiment with different durations to find the ideal balance for your financial plans, like managing debt consolidation effectively.

Frequently Asked Questions: Loan Calculator

A Loan Calculator is a tool that helps estimate loan payments based on factors like the loan amount, interest rate, and term period.

You input details like the loan amount, annual interest rate, and term period, and the calculator calculates your estimated monthly or yearly payments.

Using a Loan Calculator helps plan your budget by providing insights into potential loan payments facilitating informed financial decisions.

The Loan Amount is the sum of money you intend to borrow, influencing overall loan payments.

The Annual Interest Rate represents the cost of borrowing money, impacting the total loan expense.

The Term Period is the duration you’ll repay the loan, offering flexibility based on your financial goals.

The Loan Term Period input field lets you specify the loan duration in years or months, providing control over your financial planning.

Yes, Loan Calculators are versatile and can be used for various purposes, such as educational expenses, major purchases, or debt consolidation.

A Loan Calculator assists in budgeting and planning for financial commitments by providing estimated monthly or yearly payments.Top of Form