Country

Study Location

Study Location

Number of Dependants?

Annual Tuition Fee ($)?

Total Tuition Fee Paid ($)?

Duration of Study (years)?

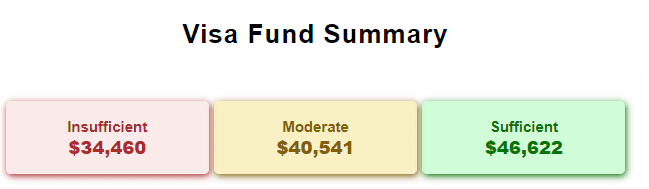

Visa Fund Summary

Insufficient 28000

Moderate 28000

Sufficient 28000

Student Visa Proof | Visa Financial Support Calculator

Planning your study abroad journey is an exhilarating adventure, but navigating the intricacies of visa applications can quickly turn that excitement into stress. Our Financial Support Calculator simplifies this process, ensuring you have a smooth transition. It’s no secret that securing a visa is a critical step in realizing your dreams of studying abroad. However, the complexities of financial requirements can often lead to confusion and anxiety. That’s where our Financial Support Calculator steps in, acting as your reliable guide through the labyrinth of budget planning. Whether you’re headed to Canada, the UK, or Australia, understanding the funds required is paramount. Our user-friendly Financial Support Calculator empowers you to accurately determine the amount needed to support your studies in your chosen destination, ensuring your visa application is on track from the start.

Imagine applying for your student visa with peace of mind, knowing you’ve covered all financial bases. Grantunity’s Financial Support Calculator makes this dream a reality by providing a straightforward way to assess your financial requirements. With our Financial Support Calculator by your side, you can confidently embark on your academic journey, fully prepared for the adventure ahead. Let us handle the numbers so you can focus on your studies and the experiences awaiting you abroad.

Understanding the Inputs

The Student Visa Proof of Financial Support Calculator is a valuable tool that simplifies determining the funds required for a student visa application in Canada, UK, and Australia. The calculator typically requires several key inputs:

- Select Country:

- Number of Dependants:

- This parameter considers the financial responsibility for any dependents accompanying the student. Dependents include spouses, children, or other family members.

- Annual Tuition Fee ($):

- The annual tuition fee is a critical factor, reflecting the cost of academic programs. Tuition fees can vary widely across institutions and countries.

- Total Tuition Fee Paid ($):

- This input accounts for any prepayments or deposits made towards the total tuition fees. It ensures accurate calculations of the remaining funds needed for the visa application.

- Duration of Study (years):

- The duration of the study can influence the overall cost of living and educational expenses although the students must show the tuitions and associated costs of living for the first year.

Calculation and Output:

Once the user provides the necessary inputs, the calculator processes the information to generate the total funds required for the student visa application. This figure encompasses various aspects, including living expenses, accommodation costs, and other miscellaneous expenditures.

The calculator provides users with a clear and concise output categorizing their financial preparedness:

Insufficient

What It Means: This outcome indicates that your current savings and financial resources are below what’s needed for your study destination. You’re not quite there yet when it comes to covering all your expenses.

Next Steps:

- Explore More Affordable Options: Consider less expensive schools or countries that are more budget-friendly.

- Look for Financial Aid: Research scholarships, grants, and student loans that might help you cover the gap.

- Budget Review: Sit down and go over your finances again. It might be time to tighten up or redirect some funds.

Moderate

What It Means: You’re in the middle ground. You’ve got a good start with your savings, but you might face challenges if unexpected costs pop up.

Next Steps:

- Plan More Precisely: Break down your costs by semester or even month to get a clear idea of what you’ll spend on things like housing, food, and transportation.

- Build Your Savings: Try setting aside a little more each month to give yourself a bigger financial cushion.

- Cut Costs Where Possible: Look into shared housing, meal planning, and student discounts to make your money go further.

Sufficient

What It Means: Great news! You have enough funds to comfortably cover all expected costs of studying and living abroad. You’re all set to go!

Next Steps:

- Keep on Track: Continue managing your money wisely to maintain this great position.

- Regularly Check Your Finances: Even though you’re well-prepared, keep an eye on your spending and savings.

- Set Up an Emergency Fund: If you haven’t already, consider creating a fund for unexpected expenses, so you’re covered no matter what happens.

Frequently Asked Questions: Proof of Financial Support Calculator

Immigration authorities require proof to ensure that students have the means to sustain themselves during their studies and won’t become a burden on the host country’s resources.

The calculator streamlines the complex task of determining the funds required for a student visa application, making it easier for individuals and institutions to demonstrate financial preparedness.

The calculator supports the selection of study destinations, including the UK, Canada, and Australia, as each country has distinct visa regulations and financial requirements.

Dependents include spouses, children, or other family members for whom the student has financial responsibility.

Users input both the annual tuition fee and any prepayments or deposits made toward the total tuition fees. This ensures accurate calculations of the remaining funds needed for the visa application.

The duration of study influences the overall cost of living and educational expenses, although the calculator focuses on the first year’s tuition and associated costs of living.

The calculator generates the total funds required for the student visa application, encompassing living expenses, accommodation costs, and other miscellaneous expenditures.

The calculator provides a clear output categorizing financial preparedness into three levels: Insufficient, Moderate, and Sufficient.

It indicates that the calculated funds fall below the minimum threshold required for the selected study destination. Users may need to explore additional funding sources or reconsider their financial strategy.

It suggests a mid-range financial readiness, where users have met some requirements but may still need to address specific aspects to ensure comprehensive coverage of expenses.

It represents a strong financial position, indicating that users have met or exceeded the minimum financial threshold for their selected study destination.

– Currently, the calculator supports the selection of the UK, Canada, and Australia due to their distinct visa regulations. Users planning to study in other countries may need to use country-specific tools.

While the calculator is designed for university students, it can be adapted for other educational programs, considering the user provides accurate inputs related to tuition fees and living expenses.

The calculator relies on current currency exchange rates to convert inputs into a common currency. Users should ensure that the rates are recent for accurate calculations.

Depending on the specific tool or platform hosting the calculator, users may have the option to save their inputs and results for future reference or adjustments.

The calculator focuses on the user-provided inputs related to tuition fees, prepayments, and living expenses. Scholarships and grants are not automatically factored in, so users should include them in the appropriate input fields.

The calculator provides estimates based on general information. Users are encouraged to research and verify specific costs associated with their chosen study destination for the most accurate financial planning.

The calculator is versatile and can be used for both undergraduate and postgraduate studies. Users should ensure they input accurate details related to their specific program and duration.

The calculator primarily focuses on demonstrating financial support without factoring in part-time employment earnings. Users relying on part-time work may need to assess its impact separately.

Depending on the tool or platform, users may find additional resources or guidance on enhancing financial preparedness or addressing specific visa application requirements. It’s recommended to explore accompanying materials for comprehensive support.